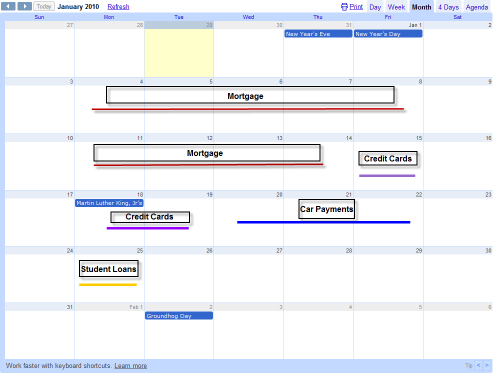

Visualize your debts and bills…

I found the picture below digging around my archives.

It's a visual representation of how long you have to work to pay each of your bills per month.

To make your own you'd figure out your monthly take-home pay and divide by the number of days a month you work.

It's usually around 20.

So for example...if you take home $3000 a month and work an average of 20 days a month, your daily earnings would be $150.

If your rent/mortgage was $900 per month that means you have to work 6 days per month just to pay your mortgage.

Do this for all your debts to give you an idea how much of your life is spent earning money to pay off debts.

If you need a plan to dramatically speed up the time it takes you to pay off your debts I encourage you to investigate my "How To Own Your Paycheck Again!" program.

http://leoquinn.com/readers.html